- Betting Startups News

- Posts

- Market & Funding Report: Q3 2025

Market & Funding Report: Q3 2025

Q3 draws nearly $100M in real-money gaming investment over a record number of deals in 2025.

Market & Funding Report: Q3 2025

BettingStartups’ Market & Funding Report provides coverage and analysis of activity in real-money gaming’s early-stage ecosystem, including funding events and macro trends. The report tracks where capital is flowing, how new technologies are reshaping products, and which categories are attracting investor attention each quarter.

(Note: This report tracks early-stage investments, from pre-seed through Series D, and does not represent all capital deployed across the industry.)

The quarter in numbers

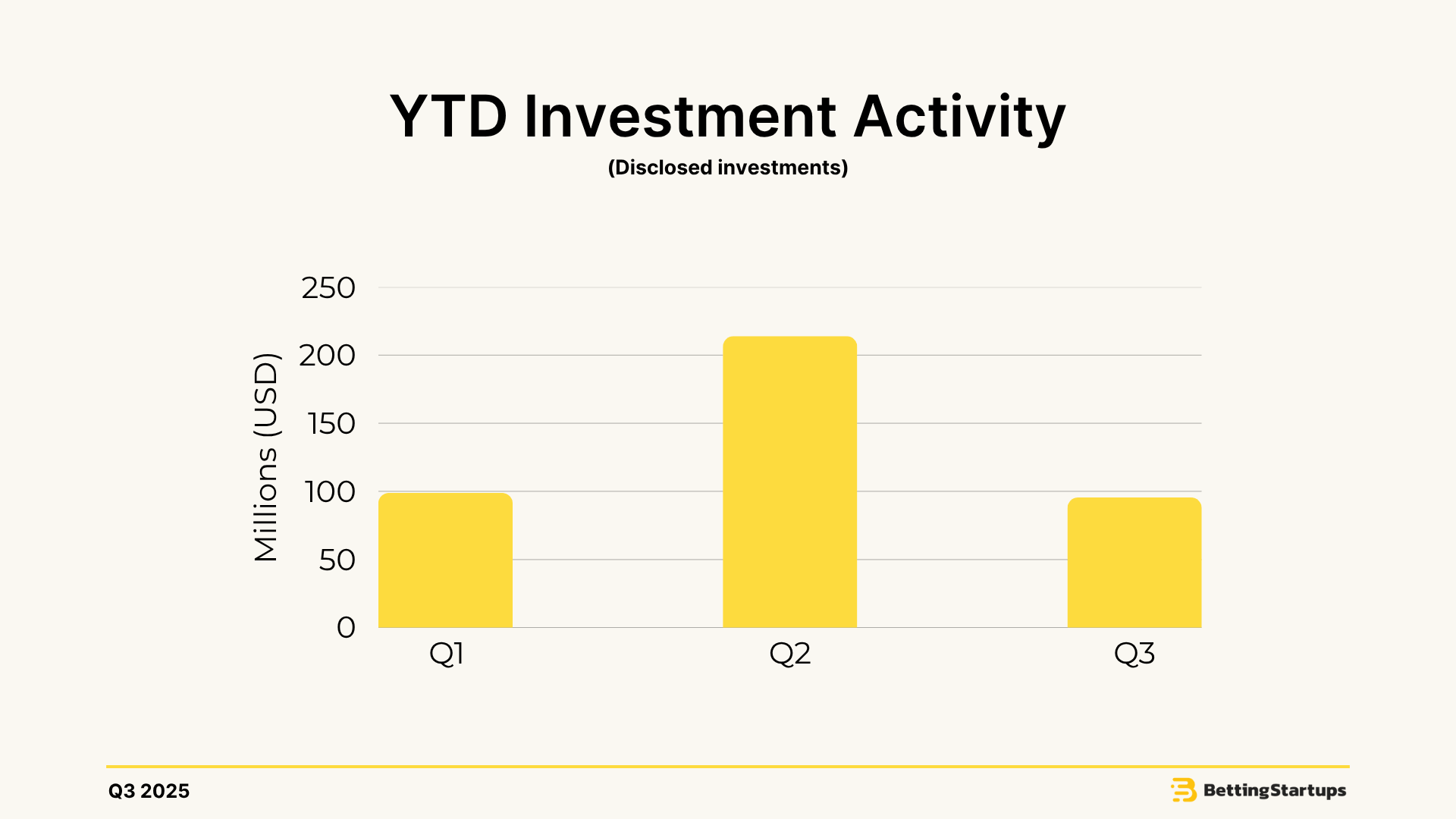

Deal activity held steady across the quarter: A total of 16 startup investments were tracked between July and September, nearly double the funding events in Q1 (9 deals) and bringing the year-to-date total to 31 deals.

Nearly $100M in new capital flowed into the ecosystem: Startups in real-money gaming raised $98.9M in disclosed funding, while six additional rounds remained undisclosed—consistent with early-stage and strategic financings that often operate under confidentiality.

Early-stage rounds dominated the landscape: Pre-seed and seed activity accounted for the majority of Q3 deals, underscoring strong momentum among emerging gaming, data, and infrastructure startups.

Larger raises continued to anchor overall funding volume: MyPrize ($21M) led the quarter, followed by Novig ($18M), The Clearing Company ($15M), and Yaspa ($12M)—together representing two-thirds of all disclosed capital raised in Q3.

Deal activity accelerates in the third quarter

Funding volume peaked in Q2 2025: Startups in real-money gaming raised approximately $214M across 6 deals, more than double the combined disclosed capital of Q1 ($95.5M) and Q3 ($98.9M), mainly thanks to a major round from Kalshi ($185M).

Deal activity accelerated midyear: The number of tracked investments rose from 9 in Q1 → 6 in Q2 → 16 in Q3, bringing the year-to-date total to 31 deals.

Average raise size compressed over time: The average disclosed round fell from $10.6M in Q1 to $9.9M in Q3, as smaller seed and strategic rounds began to outweigh a handful of larger midyear financings.

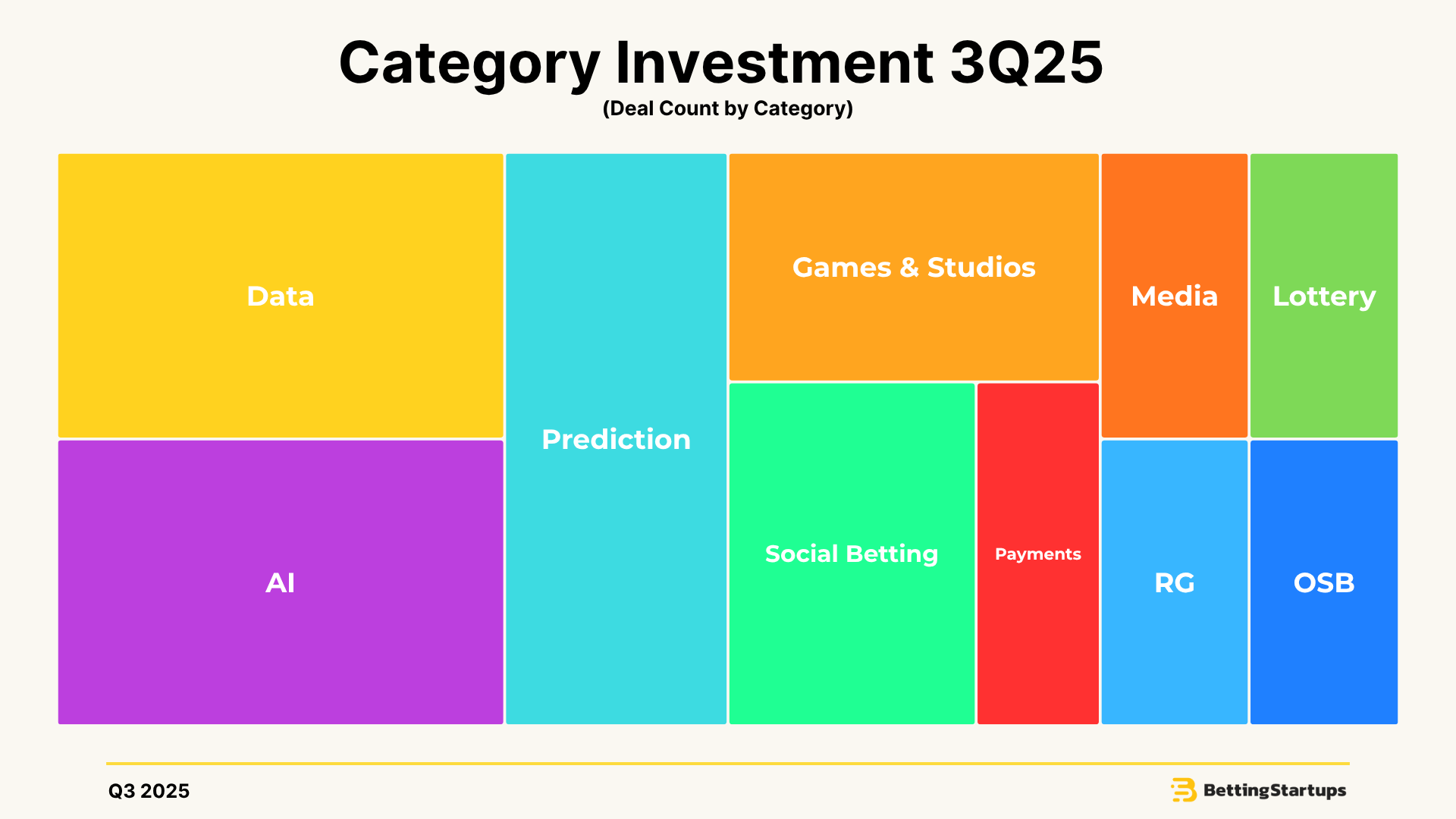

AI, data, and intelligence startups gaining funding momentum

AI and data funding hit a new high in Q3: AI- and data-centric upstarts represented nearly one-third of all funding events in Q3 2025 (5 of 16 tracked deals)—the category’s peak to date in both total capital secured and investment count.

Top fundraisers: Yaspa, which embeds AI within its payment solution, led the category with a $12M raise, followed by AIstats ($1.1M) and BillyBets ($1M) for a total of $14.1M in disclosed capital. Both Odditt and StatRankings chose not to disclose investment size or round.

Early-stage profile remains clear: The average disclosed raise of $4.7M for AI and data companies in Q3 came in below the all-sector average of $9.9M, underscoring that most innovation in this category is still happening at the seed and pre-seed level.

Macro trends to watch

Infrastructure replaces operators as investor priority

Investors are gravitating toward platforms that make the ecosystem work smarter—particularly those that can serve multiple verticals (sports betting, iGaming, DFS, and sweepstakes) simultaneously.

Discerning Capital’s Davis Catlin called it “the new world order” of betting startups—or in other words: innovating around regulation, not within it. His firm led Yaspa’s $12M round to bring open banking and AI-driven identity verification into regulated payments, while Bullpen Capital backed EQL Games to modernize the $100B U.S. lottery market. Both illustrate how infrastructure—especially those that bridge compliance, payments, and interoperability—are attracting increasing attention.

That thesis is increasingly international, too. From Random State’s European iLottery platform to Aeropay’s partnership with Soap Payments for integrated pay-by-bank and compliance, infrastructure is emerging as the connective tissue enabling scalability across markets.

AI is beginning to formalize in the industry

If AI was a buzzword in Q1, it was a business model by Q3. Momentum has grown throughout the year, with startups showcasing how artificial intelligence can be used to create tangible consumer and B2B value.

EdgeSports turned predictive modeling into a live product—plugging its AI-generated probabilities directly into Discord and Telegram communities and hitting 75% accuracy against the moneyline. SharpSports and Pine Sports merged to pair professional-grade analytics with a consumer-facing AI companion app. Meanwhile, AIstats, which raised $1.1M in Q3 and won First Pitch at SBC Lisbon, is bridging both sides of the market with an AI-native soccer analytics engine that serves fans, bettors, and clubs alike.

Even Propellor’s pivot into Atomic Communications, building chat-based AI sports agents, fits this arc. Betting startups are no longer talking about AI as a layer—they’re using it as a user interface. Across the board, the product trend is clear: conversational interfaces, real-time intelligence, and machine-assisted personalization are the new UX battleground.

Data gets contextual

Data innovation returned to the spotlight this quarter, but in a new form. Instead of raw accuracy, startups are chasing context—how, when, and where insights are surfaced.

Odditt’s strategic funding round was built on that exact premise. The startup is layering proprietary collection with qualitative context—venue dynamics, coaching styles, and player traits—to build what it calls “next-generation sports data.” Similarly, nVenue’s integration of real-time probabilities directly into NASCAR broadcasts showed how data can live inside media products, not just beside them.

The move is mirrored at Vor Interactive, which is designing interactive sports data widgets that transform static banners into click-based, data-rich experiences for affiliates. These companies share a single goal: turning data from a backend product into a front-end differentiator.

The big trend: Data is no longer just the technical backbone behind betting—it’s becoming part of the entertainment itself.

Social and creator infrastructure becomes its own category

Community is proving to be the most sustainable moat in the business. MyPrize, BtrBet, Rabbet, and Betsperts each leaned into models that treat creators, influencers, and communities as first-class participants in the value chain.

BtrBet’s “community-in-a-box” approach gives creators their own monetizable betting hubs, while Rabbet’s social picks platform adds sponsorship, charity, and friendly competition to the experience. Betsperts took it a step further, expanding its multi-brand rollup to integrate fantasy, DFS, and content properties under one media ecosystem built on “crowdfunded expertise.”

The pattern is clear: startups that harness community—rather than rent attention from it—are finding more sustainable economics. In a post-cookie world where CAC is climbing, community-based distribution is emerging as the most defensible channel in betting.

Creativity and content studios are back in style

As the infrastructure wave matures, there’s a parallel resurgence of creativity—studios that prioritize originality, narrative, and design.

Posh Monkey’s strategic deal with Velo Partners and Games Global gave the new iGaming studio access to 350+ operators and full-stack publishing infrastructure. Meanwhile, TinyRex Games is channeling video game mechanics into interactive casino titles and crash games, emphasizing agency and suspense over luck.

This creative renaissance signals a broader shift: betting content is starting to look more like entertainment IP than traditional gambling. Studios are embracing narrative, playability, and personality as differentiators—the same playbook that reshaped mobile gaming a decade ago.

Want to keep tabs on the real-money gaming industry startup ecosystem?

Subscribe to our newsletter, or follow us on LinkedIn and X.