- Betting Startups News

- Posts

- Market & Funding Report: Q4 2025

Market & Funding Report: Q4 2025

Polymarket, Kalshi help drive over $2.3B in real-money gaming capital in Q4.

Market & Funding Report: Q4 2025

BettingStartups' Market & Funding Report provides analysis of recent activity in the real-money gaming’s early-stage ecosystem, including funding events and macro trends. The report tracks where capital is flowing, how new technologies are reshaping products, and which categories are attracting investor attention each quarter.

(Note: This report tracks early-stage investments, from pre-seed through Series D, and does not represent all capital deployed across the industry.)

The quarter in numbers

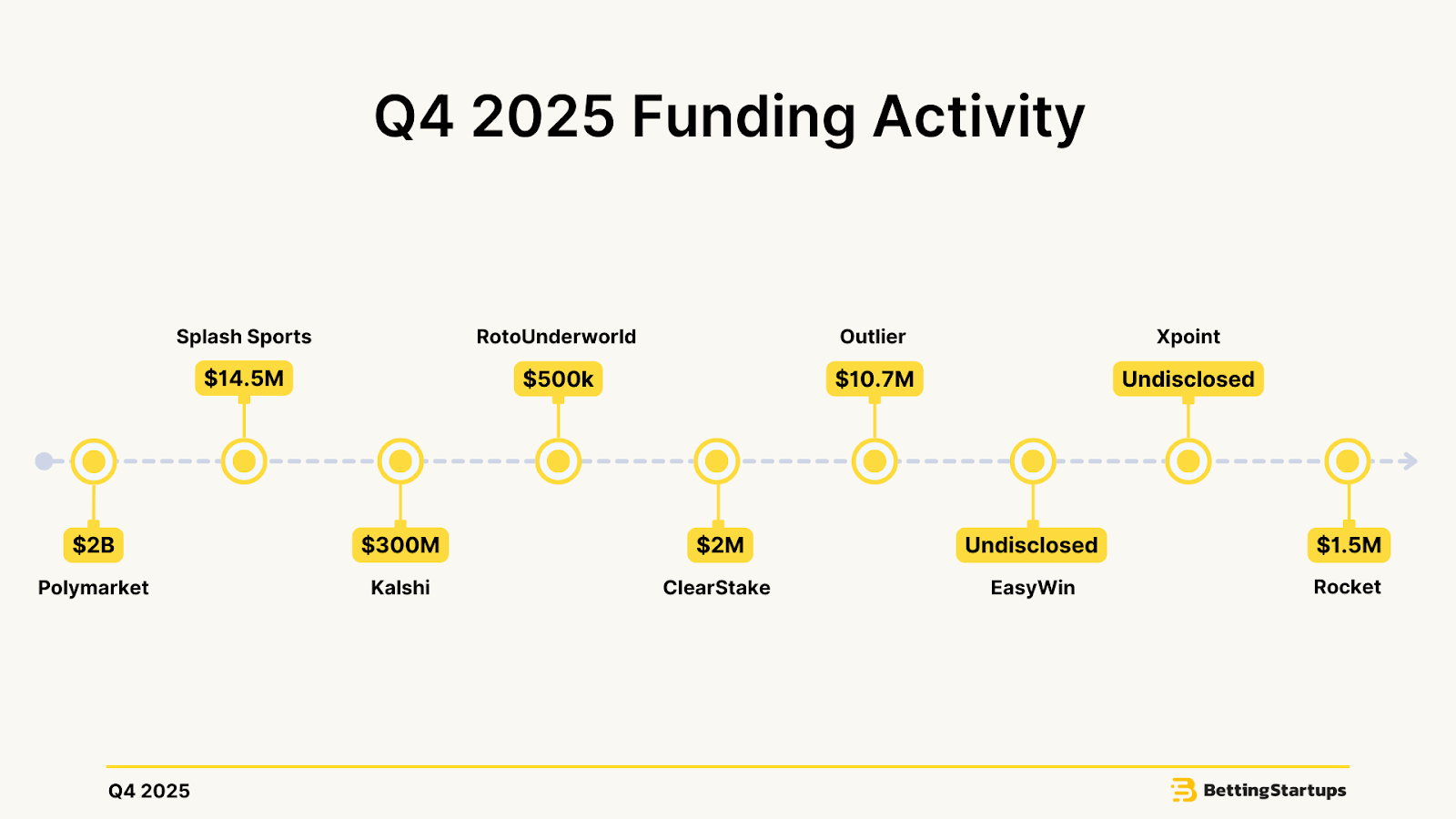

Deal activity declined quarter-over-quarter: A total of 9 startup investments were tracked in Q4 2025, down from Q3’s 16 deals, but higher than Q2 (6 deals), avoiding the sharper slowdown that often accompanies year-end fundraising.

Capital surged due to two outlier rounds: Despite fewer deals, startups raised $2.3B in disclosed funding in Q4, driven by Polymarket ($2B) and Kalshi ($300M). Excluding those two prediction market funding events, real-money gaming startups raised $29M, down 76% from Q3’s $98.9M, highlighting how headline totals masked softer underlying capital deployment.

Early-stage still dominated deal count: 7 of the 9 Q4 deals were seed, pre-seed, or undisclosed early-stage rounds, consistent with patterns seen throughout the year even as total dollars skewed heavily toward late-stage platforms.

Deal activity across 2025

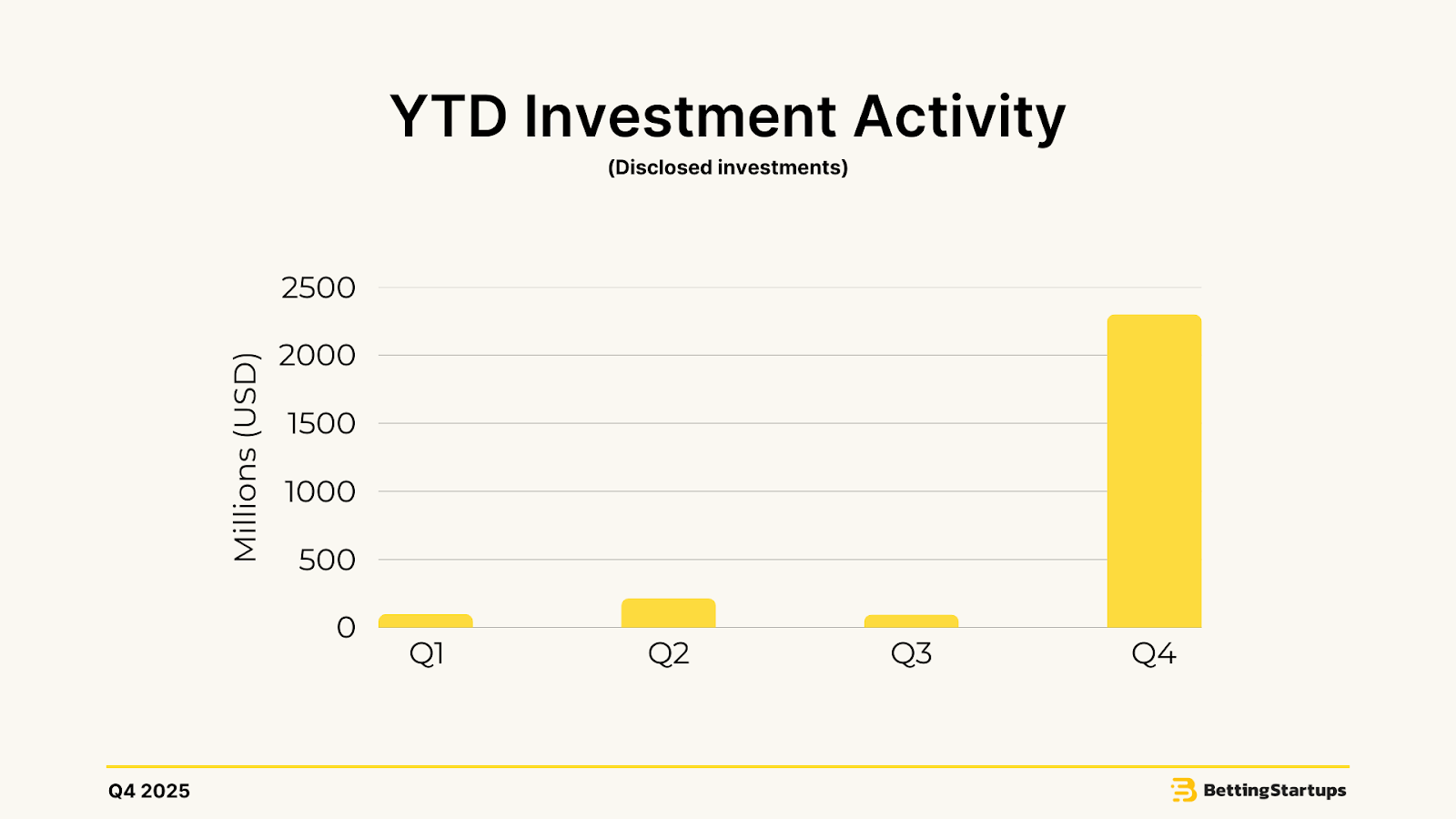

2025 closed with 40 total tracked deals: Across all four quarters, BettingStartups tracked 40 startup and early-stage investments, with deal volume rising from 9 in Q1 → 6 in Q2 → 16 in Q3, before pulling back to 9 in Q4.

Average raise size distorted by mega-rounds: Including all rounds, the average disclosed raise in Q4 was $292.9M, compared to $9.9M in Q3 and $35.7M in Q2. Excluding the two outliers, the Q4 average drops to $3.3M.

Deal cadence skewed toward the second half of the year: 63% of all 2025 deals (25 of 40) were completed in Q3 and Q4, compared to 37% (15 deals) in the first half of the year—signaling that investor activity accelerated as business models matured and regulatory clarity improved, even as capital became more selective.

Macro trends to watch

Non-dilutive and structured financing enters the mainstream

Q4 marked a maturation in how betting companies finance growth, with non-dilutive and structured capital emerging as a viable alternative to equity. Two major non-dilutive operator financing deals were announced during the quarter, representing at least $118M in available capital, led by Midnite’s $100M revolving credit facility tied directly to marketing performance and Rei do Pitaco’s $18M non-dilutive growth financing.

Alongside these deals, platform-level financings—such as Xtremepush’s $14M flexible debt facility to fund expansion and acquisitions—highlighted broader acceptance of structured capital across the ecosystem, reflecting a shift toward capital that is purpose-built rather than generalist.

Regulated infrastructure moves from necessity to strategic control

Q4 reinforced a decisive shift toward regulated infrastructure as the most defensible layer in the betting stack. Rather than launching consumer-facing products, startups focused on clearing, settlement, geolocation, and compliance—areas that determine who can participate in markets and how they scale. The Clearing Company’s move toward a federally regulated clearinghouse model for onchain prediction markets, followed by its acquisition by Coinbase, underscored how infrastructure is becoming a strategic asset rather than a background utility.

This pattern extended across the quarter, from Xpoint’s expansion of geolocation tooling to ClearStake’s verification platform in the UK. As betting formats proliferate and regulatory fragmentation increases, investors are backing companies that abstract complexity and enable scale across jurisdictions.

Betting products converge with financial market mechanics

Across Q4, betting continued to move closer to financial market infrastructure, particularly through exchange-style prediction markets and market-based pricing models. Rather than positioning the operator as the house, newer platforms emphasized price discovery, liquidity competition, and neutral market facilitation—mirroring trading venues more than traditional sportsbooks.

Infrastructure-first approaches from companies like The Clearing Company, alongside RFQ-style mechanics and increased interest from exchange-native players, point to a future where betting products are structured as markets rather than transactions. As regulatory clarity improves, investors are increasingly betting that control of market mechanics—not just consumer distribution—will drive long-term value.

Speed to market becomes a competitive advantage

Q4 underscored how speed is becoming a defining competitive advantage in real-money gaming. As regulatory, operational, and technical complexity increases, startups and operators are prioritizing tools that reduce dependency on engineering bottlenecks and long development cycles. Platforms like Flows capture this shift, enabling teams to build workflows, features, and even full products on top of live event streams without waiting months for roadmap approval.

This focus on velocity reflects a broader market reality: iteration speed now directly impacts revenue, retention, and experimentation. In a crowded landscape where sportsbooks often look and feel interchangeable, the ability to launch faster, test more frequently, and respond to user behavior in real time is increasingly valuable. Investors appear to be backing infrastructure that turns speed itself into a durable advantage.

Want to keep tabs on the real-money gaming industry startup ecosystem? Subscribe to our newsletter, or follow us on LinkedIn and X.