- Betting Startups News

- Posts

- Waterhouse VC: 2025 in Review

Waterhouse VC: 2025 in Review

This month, Tom Waterhouse talks about their results in 2025

Every month, industry investors Waterhouse VC publish an article that spotlights different aspects of the ecosystem. This month, Tom Waterhouse shares his 2025 year in review.

Waterhouse VC was established with a simple belief: wagering technology represents a significant yet often overlooked opportunity within the investment landscape. Despite the sector's scale and structural growth, it remains underserved by traditional venture capital. Over the six years since our inception, these tailwinds have only strengthened, validating our focus on the "picks and shovels" of the global gambling ecosystem.

The fund is designed to combine the Waterhouse family’s industry expertise with a curated network of wagering industry professionals across our investor base. This collective domain knowledge underpins how we identify, assess, and support portfolio companies.

Our progress in 2025 would not have been possible without the trust of our investors and partners. We are sincerely grateful for your continued support and look forward to the challenge of compounding your capital throughout 2026 and beyond.

Resilient performance

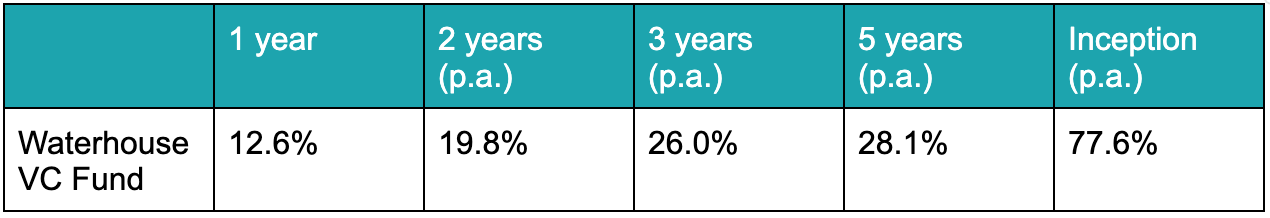

The Waterhouse VC Fund concluded 2025 with a gross return of 12.6%, achieved despite a substantial 7.7% currency headwind.

As the Australian dollar strengthened against the US dollar over the year, the reported value of our US-based holdings - which comprise our entire equities strategy - was reduced when translated back into AUD.

Inception date 19/08/2019. Performance as at 31/12/2025, shown before all fees and expenses and assumes the reinvestment of all distributions on July 1 each year. We make every endeavour to ensure results are accurate. The results are indicative only and subject to subsequent year end external financial review. Past performance is not a reliable indicator of future performance.

In 2025, returns were primarily driven by the equities portfolio, with a modest contribution of dividends received from our portfolio companies.

While no option deals were exercised during the year, we entered 2026 with 11 live deals in the portfolio. These asymmetric opportunities represent a significant pipeline for the fund as they mature.

The year in deal flow

Our investment team maintained a high level of activity throughout 2025, evaluating over 450 unique businesses. The screening process saw 66 companies progress to due diligence, ultimately resulting in six new option deals.

Two themes dominated the year and will likely set the tone for 2026. Prediction markets transitioned from niche gambling products into recognised financial instruments; the recent trend of hedge funds advertising for dedicated prediction market traders suggests the sector could mature into a mainstream asset class. We first explored this shift in our November 2024 and February 2025 newsletters. Prediction markets appear to have planted the seed of a simple expectation, particularly among young users, that you should be able to bet on anything. That shift expands the bettable surface area far beyond sport and pulls wagering closer to culture, news flow, and everyday moments. We are following the space closely and remain in active dialogue with startups and syndicates building the infrastructure, liquidity, and distribution layers for this emerging ecosystem.

Unsurprisingly, the application of Artificial Intelligence has not missed wagering, with AI rapidly being considered "table stakes" within operator technology stacks. While we identified a sharp rise in AI-first companies in 2025, we maintain a high bar for investment. For Waterhouse VC, the question is straightforward: Does the product solve an expensive problem and deliver a measurable commercial outcome? We see particularly fertile ground in personalisation and social gamification - technologies that move the dial by making the user experience more intuitive and engaging.

Updates from the portfolio

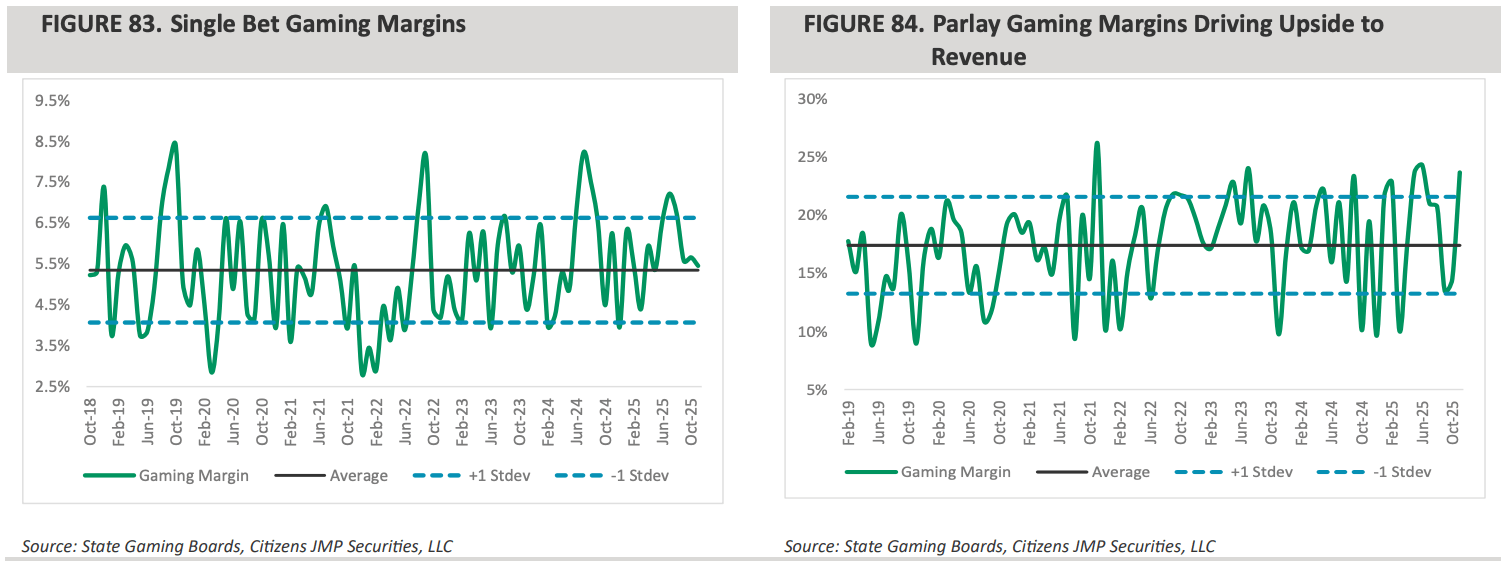

One such example is our recently extended option in Voxbet, which is set to launch "Pass The Bet." This feature allows users to collaboratively build and share parlays (also known as “multi-bets”) via a simple link, directly addressing the growing demand for social betting while removing the friction of manual bet-building. This matters because parlays now represent the highest-margin segment for operators, yielding hold percentages significantly higher than straight bets.

The large differential between gaming margins for US bookmakers on single bets vs parlays. Source: Citizens Bank

With major U.S. players like FanDuel validating this concept through similar social sharing features, Voxbet’s competitive edge lies in its "plug-and-play" capability. It delivers this sophisticated functionality to any operator without requiring a costly or time-consuming overhaul of their core infrastructure. We believe this positioning sets the stage for a significant new phase of growth as operators globally seek to protect and expand their margins through better user engagement.

One of the standout performers in our portfolio is a business focused on the rapidly growing live dealer casino segment. The business has successfully scaled its operations across multiple platforms and jurisdictions, much faster than anticipated. Our position has returned 19x our original (modest) investment in dividend income from the company's profits to date, which will grow and become a meaningful contributor to the fund as it continues its expansion.

Beyond the index: Our equities strategy

To manage the fund's capital reserves between option exercises, we employ a systematic global equities strategy. The strategy follows a strict methodology - there is no discretionary stock picking. We monitor a select group of the world's top investment managers - the likes of Bridgewater and Pershing Square. When these investors take meaningful positions, allocating more than 1% of their portfolios, we pay attention. Not every investment they make meets our criteria - we focus on businesses trading below 20x earnings, with strong growth and conservative balance sheets.

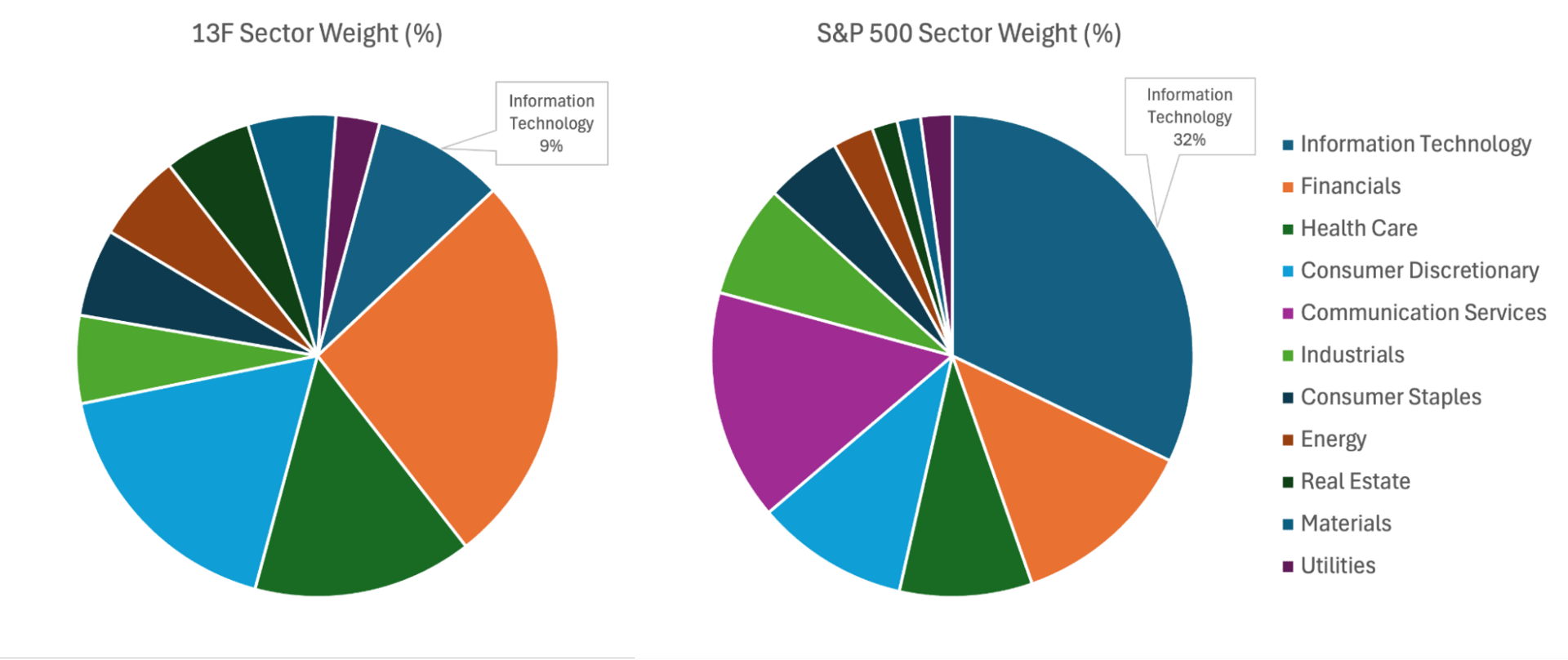

One of the most compelling aspects of this strategy in 2025 was its industrial composition compared to broader benchmarks. As of 31 December 2025, the Information Technology (IT) sector weighting within our 13F strategy sat at approximately 9%. In contrast, the S&P 500 remains heavily concentrated in a handful of mega-cap tech names, with IT accounting for a staggering 32% of the index. It is particularly impressive that our portfolio has kept pace with these indices without relying on heavy overexposure to a single industry. This diversification provides us with a more robust foundation during periods of sector-specific volatility.

Figures based on the 15 November 2025 rebalance. The 13F strategy is shown on a model equal-weighted basis to illustrate industrial composition relative to the market-cap weighted S&P 500. This model may vary from actual holdings due to market fluctuations and timing of fund inflows.

Furthermore, we believe our methodology offers a superior alternative to traditional index investing throughout the cycle. Most indices and stock screeners are built upon "descriptive attributes" - statistical measures such as industry classifications, market capitalisation, and free float available to trade. These statistics describe how a company has performed, but they are not predictive of how it will perform in future.

Our approach shifts the focus from descriptive to predictive attributes. By monitoring the conviction of elite managers, we are identifying features that predispose a stock to do well in the future. While indices look in the rearview mirror to select stocks based on where they have been, we leverage the collective intelligence of the market's best minds to position ourselves where the growth is heading.

The year ahead

As the fund approaches its soft close target, we are increasingly looking "closer to home" to drive the next phase of performance. While our reach has expanded globally, our greatest edge remains rooted in the network - evidenced by our most successful exits, such as BetMakers and Saintly. With a growing team, we are evolving our approach from being skewed towards identifying external opportunities to more actively putting together the building blocks from within our own ecosystem. We are creating a proprietary pipeline by engaging with businesses at the point of formation, a stage where Waterhouse VC can exert maximum impact. This ensures we are focusing on the opportunities that have historically driven our highest dollar value returns.

A primary focus for the coming year is the execution of high-leverage opportunities within our existing portfolio, most notably with listed company Racing and Sports (RAS). Additionally, we are monitoring the shifting regulatory landscape in our own backyard, particularly the impending regulation of online gaming and casino licenses in New Zealand. This transition represents a significant opportunity for the "picks and shovels" providers who can facilitate a smooth, compliant entry for operators into this new market.

Finally, we remain focused on solving the multi-billion-dollar issue of "turnover leakage" to illegal offshore operators, which we wrote about in our July 2025 and September 2025 newsletters. In markets like Australia, an estimated 14% of racing wagering flows to the grey market. However, racing is only one piece of a much larger puzzle. The "product gap" created by domestic restrictions on online casino games and live in-play sports betting has funnelled a staggering volume of liquidity offshore. Recent data indicates that Australians now lose approximately $3.9 billion annually to unlicensed overseas platforms - a figure projected to hit $5 billion by 2029 (Responsible Wagering Australia). New integrity tech solutions are critical to capture this lost liquidity. The year ahead is defined by a move toward chasing bigger problems and a closer proximity to the operators who define the global wagering ecosystem.