- Betting Startups News

- Posts

- This week: Fantasy Life raises $7M to launch fantasy sports product

This week: Fantasy Life raises $7M to launch fantasy sports product

Fantasy Life leaps from media brand to tech company, top investor says regulated market interest is cooling, and Betty’s blueprint for international expansion.

Fantasy Life raises $7M to launch fantasy sports product

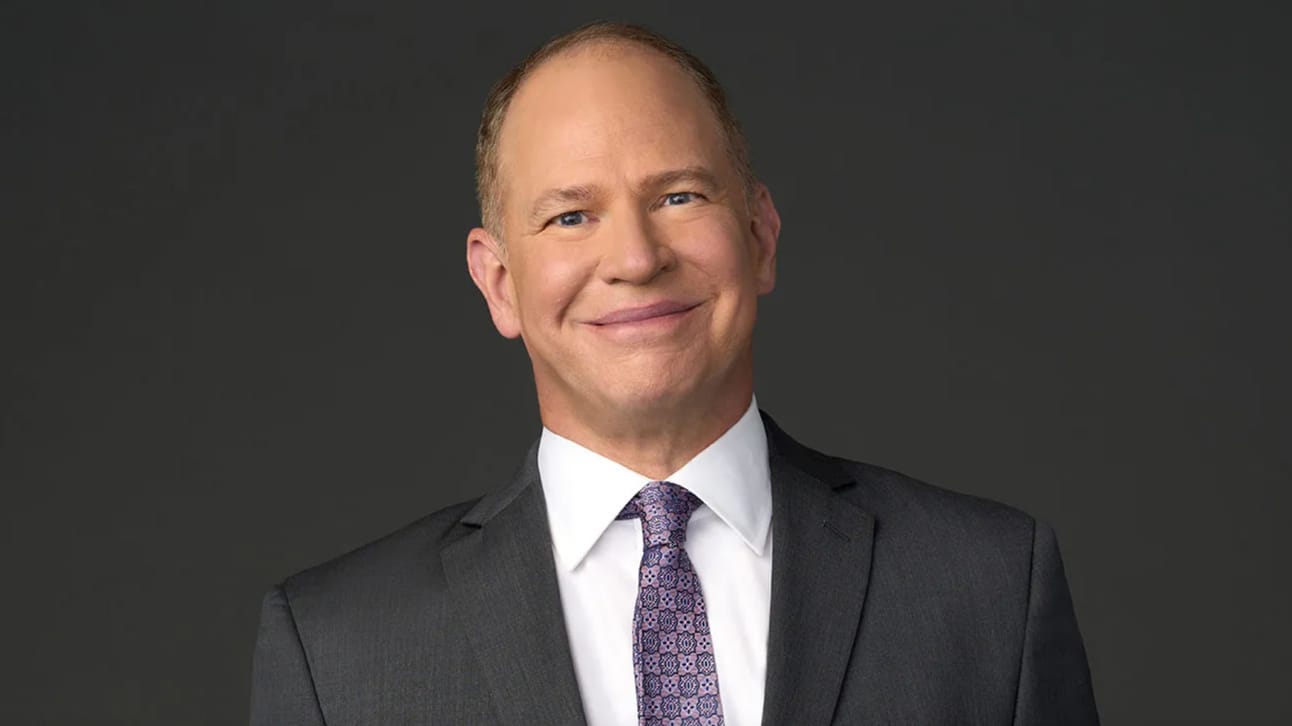

Sports writer and personality Matthew Berry raised $7M for his fantasy sports media brand Fantasy Life.

The news: Fantasy Life, the fantasy sports media brand founded by TV personality Matthew Berry, has raised $7M in new funding as it prepares to launch its first product, Fantasy HQ. The round was led by LRMR Ventures (the family office of LeBron James and Maverick Carter) and SC Holdings, with participation from high-profile investors including John Legend, David Blitzer, and Larry Fitzgerald. The news follows a $2M raise in 2023 and marks a new phase for the company as it moves beyond content.

Zoom in: Fantasy HQ is a syncable, league-specific dashboard with lineup optimization and matchup insights tailored to users’ fantasy football settings. It also features full support for Guillotine Leagues, which Fantasy Life acquired last year—a deal which allows the company to host its own game, and in turn, gain first-party customer data. Berry says the consumer app has evolved Fantasy Life into a technology company, and when paired with its media and content arm, allows them to control “the entire user journey.”

Why it matters: Fantasy Life is the latest example of how founders are using brand equity and influence to unlock instant distribution for new products. Content builds the audience while products increase engagement and develop monetization opportunities. It’s also yet another sign that tools and support-layer products are becoming the most dynamic part of the fantasy and betting ecosystem.

Investment interest in regulated markets is cooling, while tools and infrastructure segment heats up

The news: Discerning Capital’s Davis Catlin says regulated sportsbooks are becoming less attractive investment targets, citing high costs, legal complexity, and regulatory barriers to innovation on The Business of Betting Podcast. Today, B2C gaming brands need to be “innovating around the regulations,” he says. Meanwhile, category-agnostic tools and infrastructure are becoming a more compelling segment of the industry.

Zoom in: Ultimately, “gamblers don't just log into DraftKings and bet,” Catlin said—they engage with communities, tools, and data that create a more contextually rich sports betting experience. On the enterprise side, that could be upstarts like Yaspa, the payments platform Discerning led a $12M round in last week, which can support DFS, sweepstakes, and regulated books alike. For consumers, that could be a business like OddsJam, which sold to Gambling.com Group for $160M in December.

Why it matters: Investor behavior is often the clearest indicator of where the industry is heading—and right now, it’s pointing away from operators and toward the support layers. As for those operating in the regulated markets, Catlin says finding creative ways to “extend” the laws, in the same way sweeps and DFS has, is “the new world order.”

Sponsored by SBC

The news: First Pitch is back this September (16-18) at SBC Summit 2025 in Lisbon, giving real-money gaming startups a chance to pitch live to industry leaders and investors for a prize package worth over $100,000.

Why it matters: First Pitch is where startups find out if their idea really holds up—or get a wake-up call to tighten up the story and roadmap. Whether you're looking for validation, visibility, or just want to test your idea in front of the right crowd, First Pitch is your stage. Applications are open now—click here to get involved.

Betty’s growth in Ontario a blueprint for international expansion, CEO says

The news: Canadian casino operator Betty closed Q2 2025 with $42M in net revenue and more than 70,000 active players exclusively from Ontario, CEO Justin Park shared via an investor update. The company has averaged roughly 13% month-over-month net revenue growth since October 2024, achieving a $184M run rate by the end of the second quarter.

Zoom in: Park notes Ontario represents less than 1% of global GDP, teeing up the operator’s next big play: taking Betty into new markets internationally via a franchise model. The company is planning “a series of strategically structured joint ventures” armed with Betty’s product, brand, and operating playbook. Park says the UK market is “first on our list.”

Why it matters: Betty is proving it's possible to carve out real growth even in a tightly regulated, single-province market. While many operators chase scale with sprawling product suites and fleeting promo spend, Betty has taken a disciplined approach focused on a slots-only experience, targeting women players, and scaling carefully. The company is now hoping its early success can be a blueprint for international expansion and franchises.

News, money, and alpha

Kalshi and Polymarket fundraises pushed sector investment total in H1 above $500M.

Global Sports Bet Network announced a strategic partnership with CrowdCover.

Shuffle executive Ishan Haque has moved into a new role as CEO of Origami to bring crypto-style instant games to the broader real-money gaming sector.

From the studio

Catch up on the latest episodes of The BettingStartups Podcast.

You’ve made it to the end of the newsletter—seems like you should probably subscribe if you haven’t already.

Are you a startup in real-money gaming looking to announce a new product launch, partnership, or funding round? Get it on our radar! Email: [email protected]